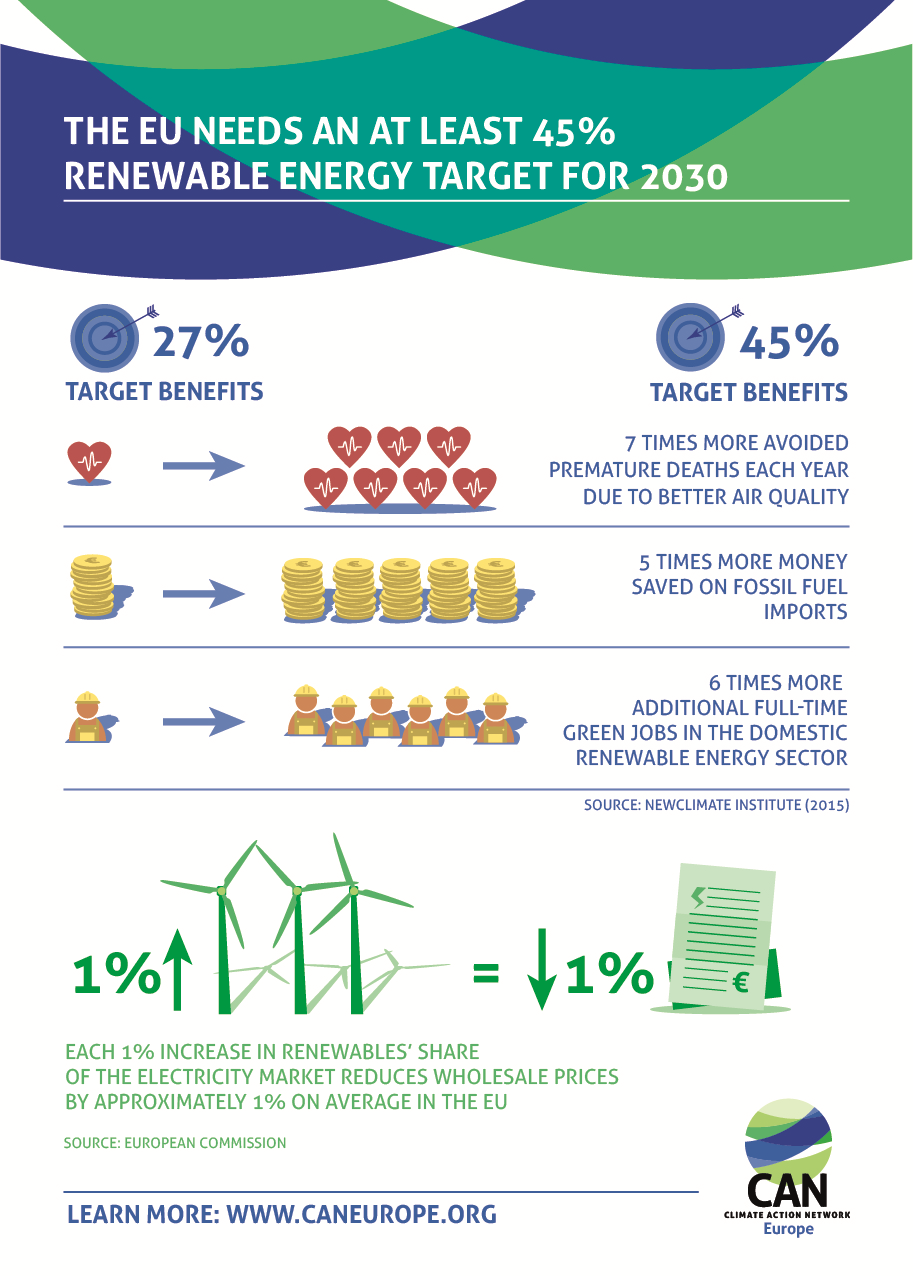

The infographic shows the multiple benefits of raising the EU 2030 renewable energy target from a mere 27% to at least 45%.

Footnotes:

(1) The NewClimate report titled ‘Assessing the missed benefits of countries’ national contributions’ of October 2015 includes a comparison of the EU INDC as submitted to the UNFCCC and an INDC strengthened to meet a trajectory towards 100% renewable by 2050 (and thus in line with keeping global warming below 2°C and possibly even 1.5°C). The latter scenario requires a renewable energy share of at least 45% by 2030 in the EU.

According to the report, the EU’s current INDC, in comparison to current policies trajectory in 2030, will:

- Save an estimated USD 33 billion each year in reduced fossil fuel imports.

- Prevent in the order of 6,000 premature deaths each year from air pollution.

- Create an additional 70,000 full-time equivalent green jobs in the domestic renewable energy sector.

If the EU strengthened its INDC to meet a trajectory towards 100% renewables by 2050, it could, according to the report, achieve the following benefits:

- Save at least USD 140 billion each year in reduced fossil fuel imports in addition to the INDC reductions, in total savings of USD 173 billion each year compared to the current policies scenario.

- Prevent in the order of 40,000 premature deaths each year from air pollution additional to the INDC improvement, in total 46,000 deaths fewer than in the current policies scenario.

- Create approximately 350,000 full-time equivalent jobs in the domestic renewable energy sector additional to the INDC scenario, in total 420,000 million more jobs than in the current policies scenario.

(2) According to the European Commission factsheet of the progress report on renewable energy accompanying the second State of the Energy Union, every percentage increase in renewables’ share of the market will decrease the wholesale market price by €0.4/MWh. This compares to an average electricity price level of €40-50/MWh.